At Money Financial Group, we specialize in providing a seamless solution for business brokers looking to expedite the sales process. Our expertise lies in Seller Carryback Financing, enabling sellers to receive a lump sum upfront and facilitating a faster closing.

A business seller note, also known as seller financing or owner financing, is a contractual agreement in which the buyer of a business agrees to make payments directly to the seller over a specified period. This arrangement allows sellers to extend credit to buyers, often when traditional financing options are limited.

1. Accelerated Sales: By funding seller notes, we offer sellers the opportunity to receive immediate cash for their business, rather than waiting for payments over an extended period. This acceleration of funds can be instrumental in facilitating urgent financial needs or investment opportunities.

2. Risk Mitigation: Sellers often face the risk of default or delayed payments when financing the sale of their business. By selling the seller note to us, sellers transfer this risk, ensuring a more predictable and secure financial outcome.

3. Enhanced Cash Flow: Our purchase of business seller notes provides sellers with a significant influx of cash, which can be utilized for business expansion, debt repayment, or personal financial goals. This enhanced cash flow empowers sellers to seize new opportunities and achieve greater financial flexibility.

4. Simplified Transactions: We streamline the sales process by eliminating the complexities associated with managing buyer payments and potential collections. In your fiduciary role of Business Broker, when dealing with MFG, you provide your clients with a hassle-free experience, knowing that their financial transaction is efficiently handled by experienced professionals.

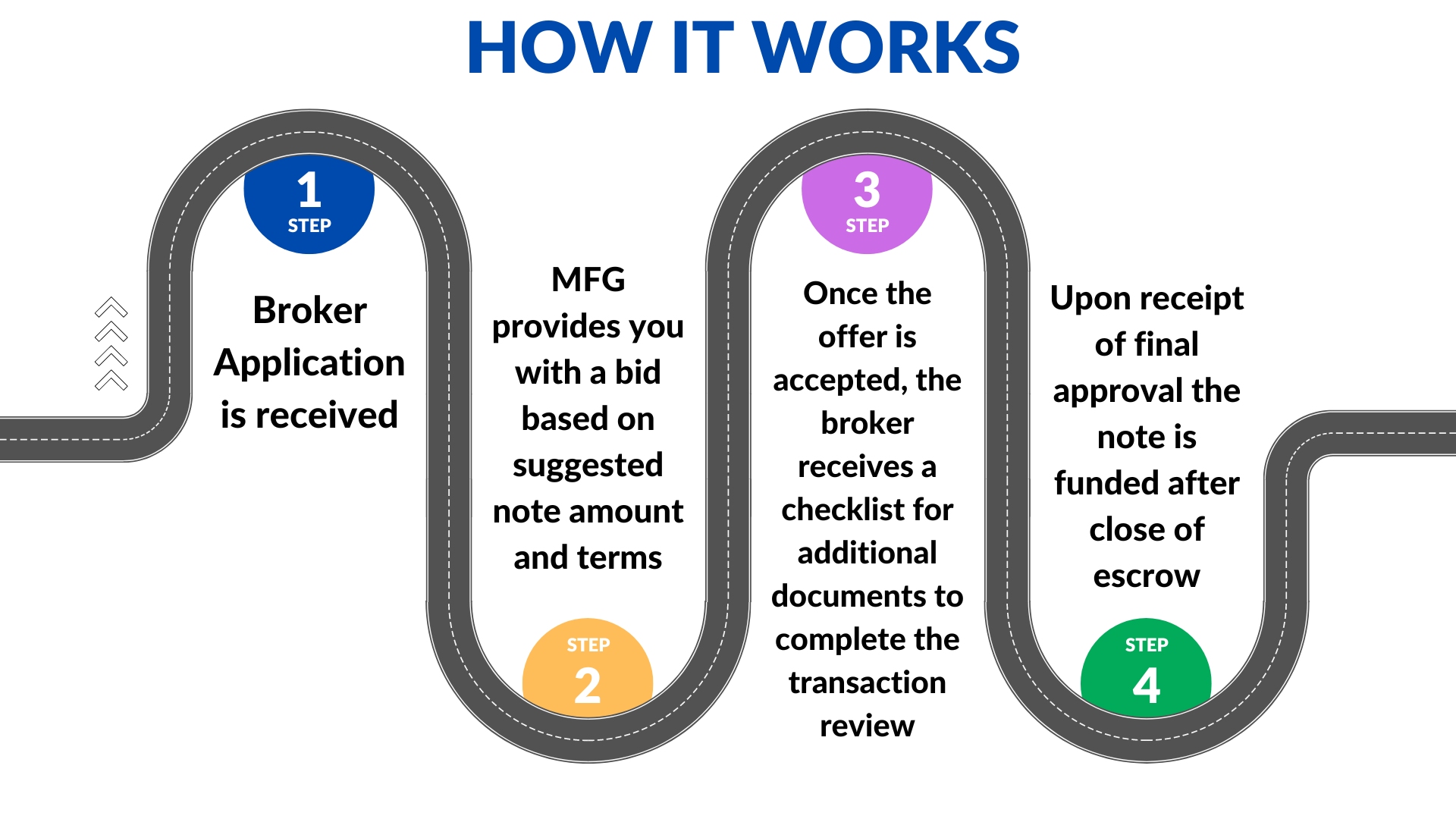

We prioritize transparency, reliability, and efficiency in every transaction. Our team of experts is committed to providing personalized solutions tailored to the unique needs of each seller and broker we serve. We always provide fast and competitive bids for partial or full notes cash out within 24 hours from receipt of an application and make funds available at escrow within two weeks.

Seller financing, also known as owner financing or seller carryback, is a common method used in business acquisitions where the seller provides financing to the buyer. In this arrangement, instead of the buyer relying solely on traditional lenders such as banks or financial institutions, a portion or all of the purchase price is financed directly by the seller.

How Seller Carryback Financing Works:

Terms Negotiation: Seller financing terms are negotiated between the buyer and the seller, including the interest rate, repayment schedule, and any collateral or guarantees required.

Down Payment: The buyer typically makes a down payment upfront, which is often lower than what traditional lenders may require. This down payment demonstrates the buyer's commitment and may vary depending on the agreement reached between both parties.

Promissory Note: A promissory note is created outlining the terms of the seller financing agreement, including the loan amount, interest rate, repayment schedule, and any collateral or security interest.

Closing Process: Seller financing is often integrated into the overall sale transaction, with legal documentation executed at the closing of the sale.

Our Role in Seller Financing:

At Money Financial Group, we specialize in purchasing seller notes for business acquisitions. We understand the importance of seller financing in facilitating successful business transactions. Our team works closely with business brokers to provide fair and competitive offers for seller notes, allowing sellers to receive a lump sum payment upfront while we manage the ongoing financing arrangements with the buyers.

© 2024 Money Financial Group. All Rights Reserved.

Money Financial Group Corporation – a division of Kenpco Enterprises Inc.

If you want to find out more or simply have any questions, don't hesitate to fill out the form below. We'll be sure to give you a call!*

*We may send you appointment reminders via text after you become a client