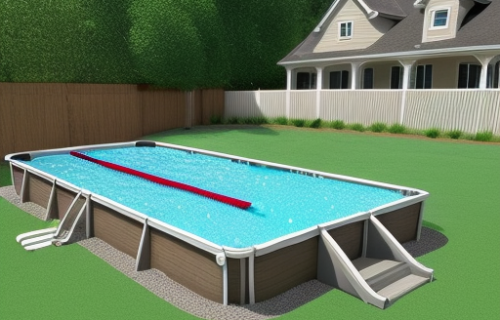

Those who want a pool in their backyard, know that pools cost a lot of money. The thought of lounging by the water on a hot summer day is undoubtedly appealing. However, the cost of purchasing and installing an above-ground pool can be a significant investment. Fortunately, there are various swimming pool financing options available that can help you bring your dream to life. This comprehensive guide will explore the various financing available for above-ground pools. We will cover everything from swimming pool loans to payment plans, we are helping you find the best type of loan to pay for your pool. Whether you have a limited budget or specific preferences, we've got you covered. Let's dive in and make your dream backyard a reality!

Welcome to our detailed guide to finding the lending option that offers the best financing to make purchasing a high-quality above-ground pool easy. In this article, we will discuss various financing solutions that can help you turn your dream of owning a new pool into a reality. Whether you have a specific budget in mind or are looking to make monthly installments, there are options available to suit your needs. Let's begin by exploring the benefits and why they are a popular choice for many homeowners.

This type of pool can also offer numerous benefits that make them an attractive choice for homeowners. Some of the key advantages include:

Now that we understand the advantages, let's delve into the various lending options available to make owning a pool a reality.

This type of financing refers to the different methods you can use to fund your project. Whether you choose to get a personal loan or select a third-party lender understanding the lending options that are available will help you make an informed decision. Let's explore the most common type of financing for above ground swimming pools.

One of the best options for above ground pools is a traditional loan. These loans are typically offered by banks or credit unions and involve borrowing a lump sum to pay for a pool. The decision is highly based on credit and will involve a hard credit pull. Banks and credit unions are very familiar with financing home improvement projects. Traditional loans often offer competitive interest rates and flexible repayment terms, making them a popular choice for many homeowners.

You can receive offers in as little as 60 seconds!

Many manufacturers partner with pool financing companies to help customers cover the cost. Manufacturer financing often comes with special offers and promotions, such as low or zero-interest rates for a specific period. This option can be convenient as it allows you to finance a pool and any additional equipment or accessories you may need.

If traditional loans or manufacturer financing are not viable options for you, there are alternative financing solutions available. These options cater to individuals with specific needs or circumstances, such as those with lower credit scores or unique financial situations. Some alternative options include:

As a borrower, exploring these alternative options can help you find a financing solution that aligns with your requirements.

When evaluating different lending options for your above ground pool, there are several factors to consider:

It is very important to clearly understand the rates and terms, fees or prepayment penalties, and what may be required by the lending partners. By carefully assessing these factors, you can select the financing option that best suits your budget and preferences.

The major advantage of utilizing financing is you can buy now pay later. Once you have decided on a lending solution, the next step is to apply for a loan. The application process will vary depending on the lender or financing institution. Typically, you will be required to provide information about your income, credit history, and the details of the pool you intend to purchase. It's important to gather all the necessary documents and fill out the application accurately to increase your chances of approval.

Yes, there are still various options available for individuals who don't have excellent credit. Alternative financing solutions, such as peer-to-peer lending or specialized financing companies, may be more lenient when it comes to credit requirements.

The down payment requirements can vary depending on the lending option you choose. Traditional loans often require a down payment, whereas some manufacturer financing programs may offer no or low down payment options. It's important to clarify this with the lender before proceeding.

The interest rates can vary subject to credit score, loan term, and the type of lending option you choose. On average, interest rates or APRs for this type of financing can range from 4% to 10% but as always rates are subject to change without notice.

Depending on the financing option, you may be able to include the installation and additional accessories such a liner in the loan amount. Manufacturer financing programs often allow you to finance the complete package, including installation and necessary equipment.

Yes, some financing programs may offer promotional offers, such as zero-interest financing for a specific period or discounted rates. It's worth exploring different options and checking for any available incentives before making a decision.

This will depend on the terms and conditions of your specific loan agreement. Some loans allow early repayment without penalties, while others may have prepayment penalties or fees. It's essential to review the terms before signing the loan agreement.

The length of the financing process varies depending on the size of the loan, the lender, and the complexity of your application. In some cases, you may receive a decision within a few business days, while others may take longer. It's advisable to start the financing process early to allow ample time for approval and planning.

Yes, you can still explore your options even if you rent your home. However, it's important to check with the lending or financing institution about their specific requirements and any additional documentation they may require. Options include unsecured personal loans, which are usually offered to renters.

Applying for financing will typically result in a hard inquiry on your credit report, which may temporarily affect your credit score. However, if you make regular, on-time payments, it can also help improve your credit rating over time.

Yes, it is possible to get financed even if you have an existing mortgage. However, it's important to consider your current financial situation. Be sure that the monthly payments for both the mortgage and financing of your pool fit comfortably within your budget. You may even add equity in your home.

Financing an above-ground swimming pool can make your backyard oasis a reality. By exploring the various options you can find the perfect fit for your budget and preferences. Remember to consider factors like interest rates, repayment terms, and eligibility criteria when making your decision. Applying for financing is a straightforward process, and once approved, you can start planning for the installation of your pool. Get ready to create lasting memories and enjoy the summer sun with your very own above ground pool!

© 2024 Money Financial Group. All Rights Reserved.

Money Financial Group Corporation – a division of Kenpco Enterprises Inc.

If you want to find out more or simply have any questions, don't hesitate to fill out the form below. We'll be sure to give you a call!*

*We may send you appointment reminders via text after you become a client