Learn how your company might be eligible to get up to $26,000 per employee for wages that were paid during the pandemic. We can make the most of your California Employee Retention Tax Incentive with a brief application process that will take only 15 minutes of your time.

Apply today and take advantage of our ERTC financing program to get your funds faster than the IRS

The Employee Retention Credit (ERC) is a Payroll Tax Credit that Pasadena organizations can obtain for the wages paid to employees during COVID-19. The Credit was initially signed in March 2020 as part of the CARES Act. The credit was later expanded with the Consolidated Appropriations Act in December 2020 and the American Rescue Plan Act in June 2021.

Business Owners can receive a refundable credit of up to $5,000 per employee in 2020, and up to $7,000 per employee, per quarter (excluding the 4th quarter) in 2021, for qualified employee wages for a total amount of up to $26,000 per employee.

As a part of the American Rescue Plan Act, the ERC program works to provide aid to small businesses and unlike the paycheck protection program (PPP) loan, you are not required to repay the ERC credit amount.

This tax credit program is designed to help businesses recover from COVID-19 suspensions.

Enacted as part of the CARES Act in March 2020 to help Pasadena Businesses

ERTC is a refundable credit to be used the way you need and toward the necessary tools to recover your business.

A wide range of business owners do not know about the Employee Retention Tax program or how the refundable tax credit is a claim on qualified wages paid for businesses to keep employees during 2020 and 2021.

Businesses that are wanting to secure the Employee Retention Credit (ERC) must fulfill one of the two qualifications in order to be eligible.

Please note: to qualify for the credit, you must have had an average of 500 or fewer full-time employees in 2019, 2020, or the first quarter of 2021.

There are many eligible businesses that can apply, including Essential Businesses. Here are some common industries:

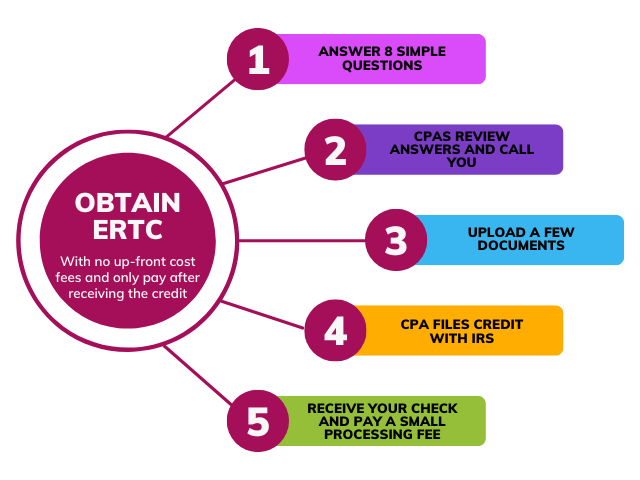

Claiming your ERTC is simple with Money Financial Group, and we can help you to secure your ERTC before time runs out.

To acquire the Employee Retention Credit, employers must apply by sending an application and producing evidence of business operations that were suspended a result of governmental action related to the COVID-19 pandemic. This can consist of documentation of the orders or restrictions that caused the suspension of normal business operations. As well as proof of any wages paid for employers to retain employees during the period of suspension. Also, have the profit and losses for 2019-2021, the internal revenue service Form 941 for each quarter of 2019-2021, as well as the gross receipts for the two-year period.

The eligibility requirements are not very extensive and we encourage any and all small California businesses that remained in operation and maintained employees during the pandemic to apply. Businesses can claim this credit based on the wages that they paid to their employees during COVID-19. And when they experienced a significant loss of business due to governmental restrictions and difficulty getting the supplies necessary to do their job.

The time to claim the credit is expected to run out in 2024, so it is more important than ever to get in your application. Submit your application today to learn if your Orlando business is eligible for the Employee Retention Tax Program claim.

© 2024 Money Financial Group. All Rights Reserved.

Money Financial Group Corporation – a division of Kenpco Enterprises Inc.

If you want to find out more or simply have any questions, don't hesitate to fill out the form below. We'll be sure to give you a call!*

*We may send you appointment reminders via text after you become a client